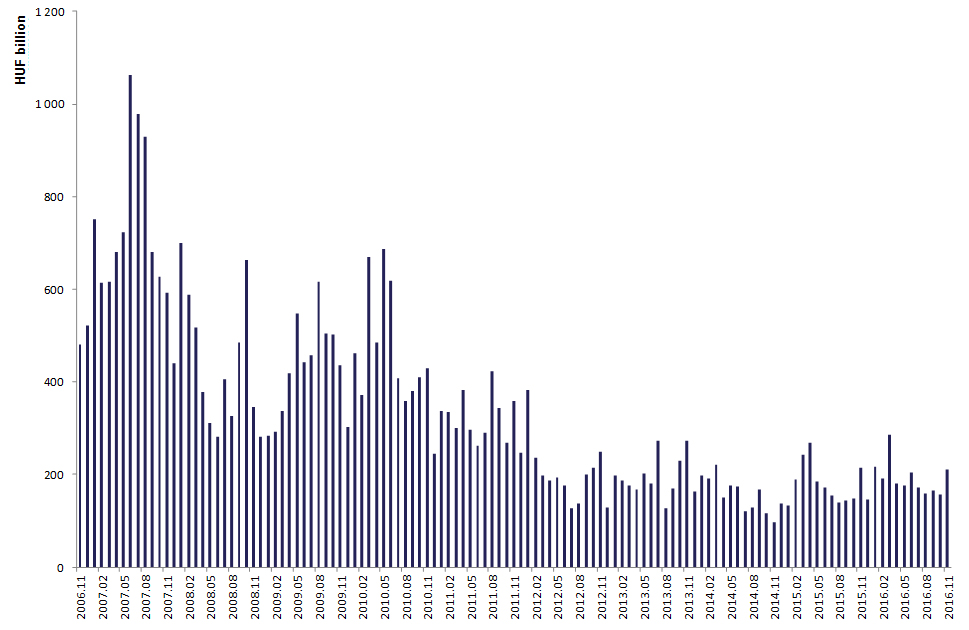

In November, the total value of trades executed by investors on the equity market of the Budapest Stock Exchange (BSE) amounted to HUF 210 billion, marking a significant increase from October’s HUF 156 billion turnover, but still slightly down year on year (HUF 216 billion). Average daily equity turnover exceeded both last November’s and this October’s values: investors executed trades to the amount of HUF 10 billion on average in shares listed on BSE over 21 trading days.

Monthly equity market turnover

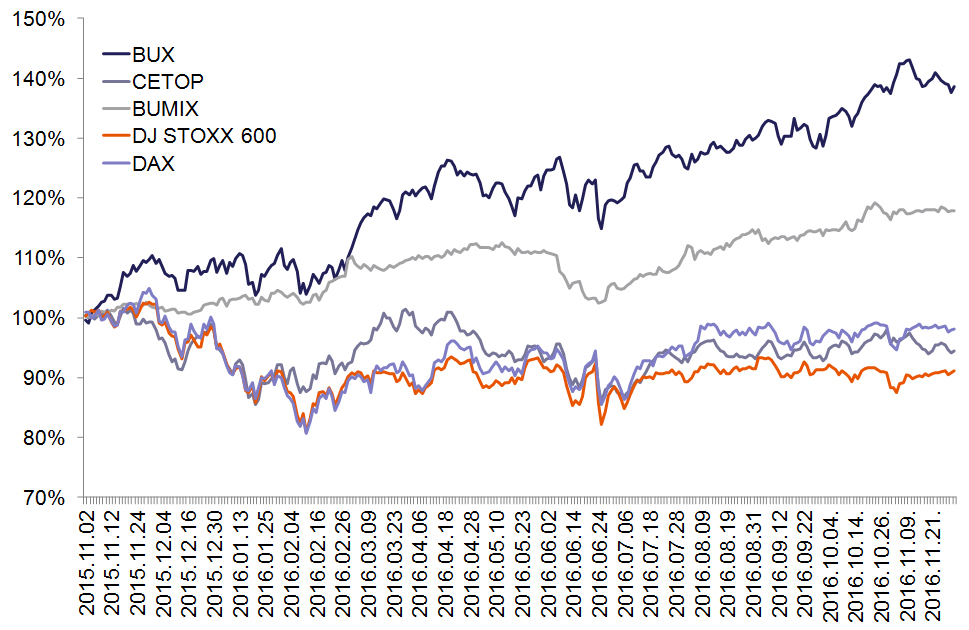

On 10 November, the BUX index closed at a new record high of 30,540 points, passing the previous peak of 30,118 points reached in 2007. Towards the end of the month, the index remained basically unchanged, arriving at 30,014 points after a 0.71 increase on the last trading day of the month.

Relative changes in index values

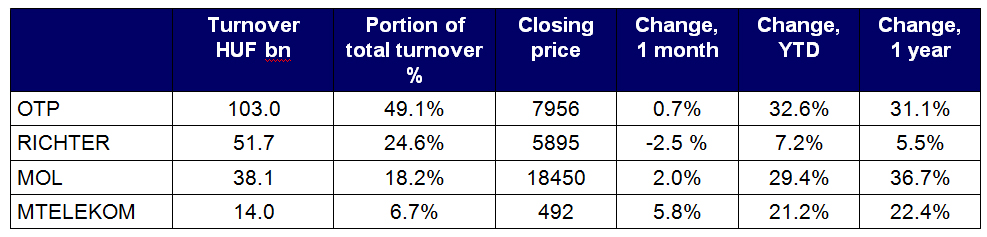

In November, shares with the highest turnover turned in a mixed performance, the clear winner of the month being MTELEKOM with a 5.8 per-cent increase, with OTP and MOL gaining 0.7 and 2.0 per cent, respectively. After reaching a historic peak on 10 November, Richter started to decline, closing out the month with a 2.5 per-cent decrease.

Blue-chip turnover and price movement

The duplicated turnover in the equity market was HUF 419 billion. There were considerable changes at the top of the rankings for service providers compared to October: Wood & Company Financial Services a.s. came in first with a HUF 99 billion turnover, while last month’s best, Concorde Értékpapír Zrt., dropped down to second place with HUF 81 billion, with Equilor Befektetési Zrt. taking the third position with HUF 72 billion.